indiana excise tax refund

Pay my tax bill in installments. If you take the standard deduction on your 2020 tax return you can deduct up to 300 for cash donations to charity you made during the year.

Dor A Look Into Project Nextdor Rollout 3 Tax Types

INDIANA COUNTY VEHICLE EXCISE TAX AND WHEEL TAX for an example of how the tax is calculated.

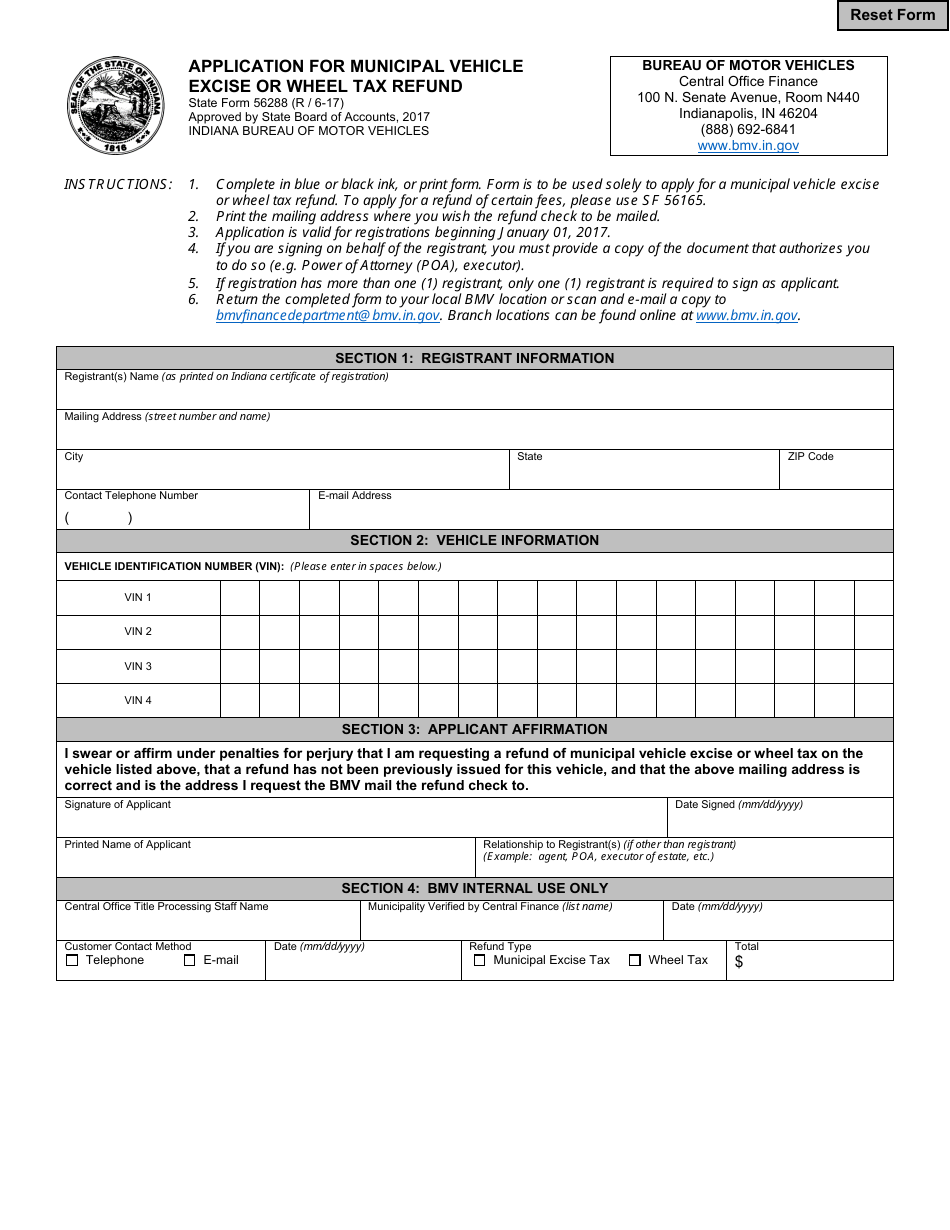

. EXCISE OR WHEEL TAX REFUND State Form 56288 R 6-17 Approved by State Board of Accounts 2017 INDIANA BUREAU OF MOTOR VEHICLES BUREAU OF MOTOR VEHICLES Central Office Finance 100 N. As a result those customers overpaid excise taxes when registering their vehicles. Anyone who purchased un-dyed special fuel or gasoline paid the Indiana excise tax and later used it for an exempt tax-free purpose.

Incentives may exist allowing certain state of federal excise taxes to be refunded on goods bought for specific uses but such incentives change frequently. Be on the lookout for an Indiana Bureau of Motor Vehicles claim form in the mail. Taxpayer Information Indicate the month and year for which the return is being filed in the appropriate spaces provided.

Inquiries can be made on refund amount s from 2017 to the current tax season. For more information about cigarette excise taxes or other tobacco product excise tax please contact DOR Special Tax Division. Have more time to file my taxes and I think I will owe the Department.

Supporting schedule to be filed with ALC-DWS. However if you would like to check to see if you are eligible for a refund or you would like to. The Resource Form 8849 claim for refund of excise taxes Online Label.

A 300 BMV processing fee will be deducted from the refund amount per IC 6-6-5-72 for Motor Vehicle Excise Tax or 6-6-51-30 for RVET. If the fuel is being used in a vehicle the declared gross weight must be 26000 pounds or less. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

Name As It Appears on Permit Indicate the entity. Please allow 2-3 weeks of processing time before calling. Take the renters deduction.

Complete in blue or black ink or print form. Monthly Excise Tax Return for Out-of-State Direct Wine Sellers. The BMV has begun sending out claim forms to residents who are entitled to Excise Tax refunds dating back to 2004.

For 2020 joint returns the amount allowed is still only 300 The 60-of-AGI limit on cash contributions was removed for the 2020 and 2021 tax years What is excise tax on a car in Indiana. Senate Avenue Room N440 Indianapolis IN 46204 888 692-6841 wwwbmvingov INSTRUCTIONS. O Refunds of the Surcharge tax are available to non-motor carriers who purchased special fuel diesel biodiesel compressed natural gas or liquified natural gas in Indiana from July 1 2017 through June 30 2018.

By telephone at 317-232-2240 Option 3 to access the automated refund line. The REF-1000 form is used to file for a refund of un-dyed special fuel excise tax gasoline excise tax and oil inspection fee. The collection Form 8849 claim for refund of excise taxes Online represents a specific aggregation or gathering of resources found in Indiana State Library.

Monthly Excise Tax Return for Indiana-Based Farm Wineries. The refund amount must be at least 400 to be eligible to receive a refund check. Subscribe to RSS Feed.

Indiana Motor Carriers and IFTA Carriers should use Form. Know when I will receive my tax refund. For more information about the technical requirements for submitting files please contact the DOR Information Technology Division.

Indiana Excise Tax Credits and Refunds If you have sold your vehicle or if it has been destroyed a total loss you can apply for a credit or refund of a portion of the excise taxes that you paid. Complete in blue or black ink or print form. Supporting schedule to be filed with ALC-FW.

Claim a gambling loss on my Indiana return. About 185000 or 36 percent of the 51 million Hoosiers who registered vehicles with the BMV since 2004 are entitled to refunds. If you have sold or destroyed total loss a vehicle you may apply to receive a creditrefund of a portion of the Indiana vehicle excise taxes by submitting Application for Vehicle Excise Tax Credit Refund State Form 55296.

Current estimates indicate that the BMV will issue about 29 million in. Questions If you need further assistance you can contact us at 317 615-2710 or at excisetaxdoringov. The following rules apply.

While sales tax refunds are available for goods that are purchased in Indiana and exported Indiana excise taxes paid on goods are generally non-refundable. The vehicle make model and Vehicle Identification Number VIN must be included along with purchase receipts. 0 3 7695 Reply.

Indiana Excise Tax - References. This only applies to vehicle owners who paid a vehicle recreational vehicle county vehicle or municipal vehicle excise tax. INDIANAPOLIS AP The Indiana Bureau of Motor Vehicles has created a website where motorists can determine whether theyre eligible for a refund on excise taxes theyve paid when registering cars.

APPLICATION FOR VEHICLE EXCISE TAX REFUND State Form 55677 R 10-14 Approved by State Board of Accounts 2014 INDIANA BUREAU OF MOTOR VEHICLES Bureau of Motor Vehicles Winchester Processing Center PO Box 100 Winchester IN 47394 888-692-6841 INSTRUCTIONS. Find Indiana tax forms. If the fuel is being used in a vehicle the declared.

Special fuel or gasoline excise taxes. 5 or 10 of tax due whichever is greater. Everyone eligible for a refund will receive a claim form in the mail.

Anyone who purchased un-dyed special fuel or gasoline paid the Indiana excise tax and oil inspection fee and later used it for an exempt purpose. Ad See How Long It Could Take Your 2021 State Tax Refund. Some tax returns may take longer to process due to factors like return errors or incomplete information.

The agency says all claim forms will be mailed within the next 30 days. New Member June 4 2019 832 PM. Form 8849 claim for refund of excise taxes Online Resource Information.

December Tax Bulletin Clarification On Intime Services

Important Information On Project Nextdor Part Ii

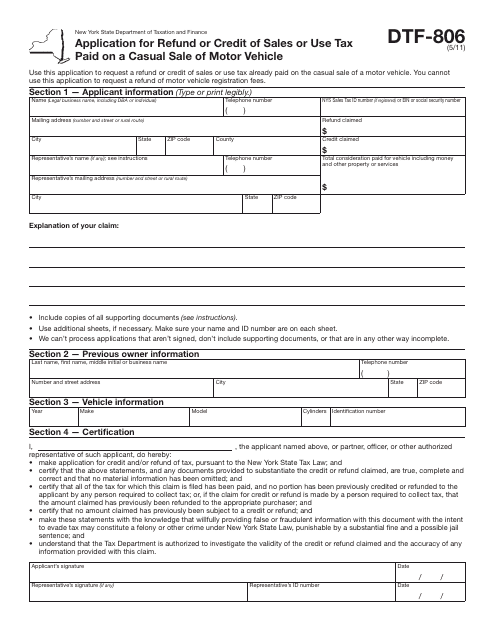

Form Dtf 806 Download Printable Pdf Or Fill Online Application For Refund Or Credit Of Sales Or Use Tax Paid On A Casual Sale Of Motor Vehicle New York Templateroller

State Form 56288 Download Fillable Pdf Or Fill Online Application For Municipal Vehicle Excise Or Wheel Tax Refund 2017 Templateroller

Dor Owe State Taxes Here Are Your Payment Options

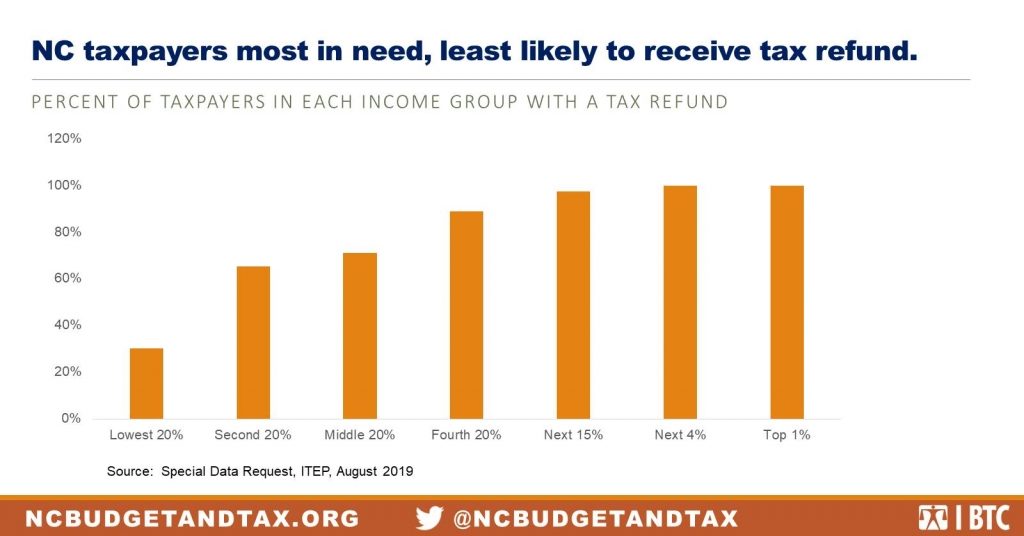

New Analysis A Third Of Nc Taxpayers Won T Benefit From Proposed Tax Refund Plan Itep

Last Minute Dash When Where How To File Those Last Minute Tax Returns Tax Return Tax Paying Taxes

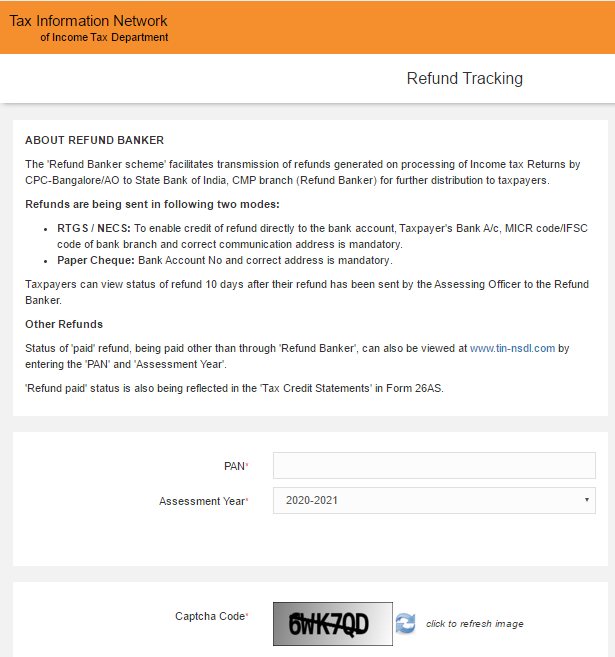

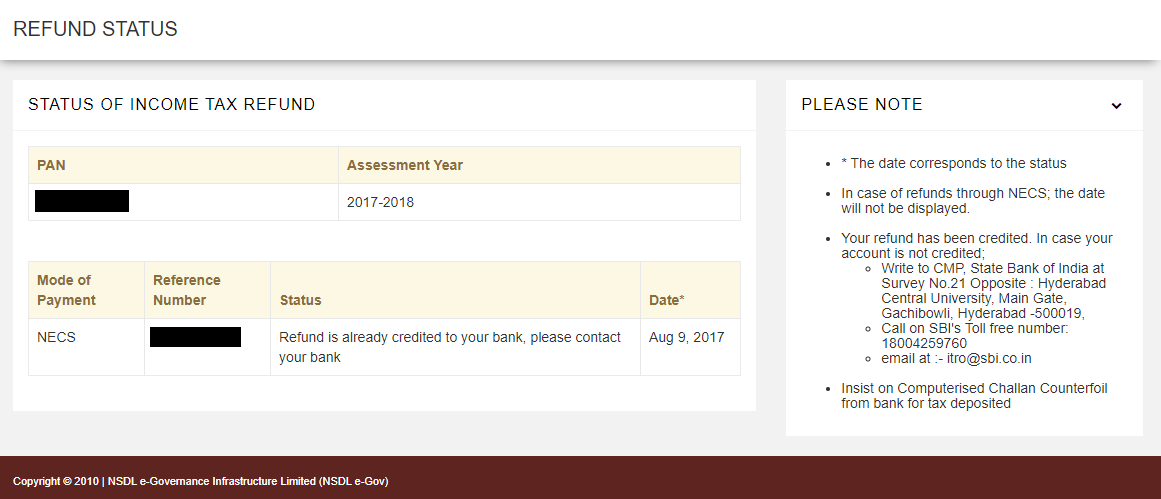

Income Tax Refund How To Check Claim Tds Refund Process Online

Are You Eligible For An Excise Tax Refund Find Out Here Wsbt

What Are Marriage Penalties And Bonuses Tax Policy Center

State Form 55296 Download Fillable Pdf Or Fill Online Application For Vehicle Excise Tax Credit Refund Indiana Templateroller

Income Tax Refund How To Check Claim Tds Refund Process Online

Bmv To Refund Customers 29 Million Because Of Tax Error News 2014 Indiana Public Media

Child Tax Credit January 2022 When Could Ctc Payments Start In 2022 Marca